Impairment

Meaning of Impairment

Ind AS 36 on Impairment of Assets ensures that an entity’s assets are not carried at more than their recoverable amount. Except for goodwill and certain intangible assets that require an annual impairment test, entities are required to conduct impairment tests when there is an indication that an asset may be impaired. If an asset does not generate largely independent cash inflows, the impairment test may be conducted for a ‘cash-generating unit.’ Impairment loss is recognized only when there is a decrease in the value of the assets that is not temporary in nature

Certain Key term

| 1. Carrying amount – The smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. |

| 2. Corporate assets – Assets other than goodwill that contribute to the future cash flows of both the cash-generating unit under review and other cash-generating units. |

| 3. Costs of disposal – Incremental costs directly attributable to the disposal of an asset or cash-generating unit, excluding finance costs and income tax expense. |

| 4. Depreciable amount – The cost of an asset, or other amount substituted for cost in the financial statements, less its residual value. |

| 5. Fair value – The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (refer Ind AS 113 Fair Value Measurement). |

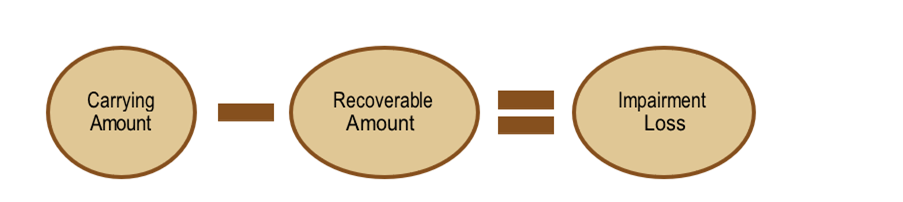

| 6. Impairment loss – Amount by which the carrying amount of an asset or a cash- generating unit exceeds its recoverable amount. |

| 7.recoverable amount – The higher of its fair value less costs of disposal and its value in use. |

8. Useful life is either:

a) The period of time over which an asset is expected to be used by the entity; or

b) The number of production or similar units expected to be obtained from the asset by the entity. |

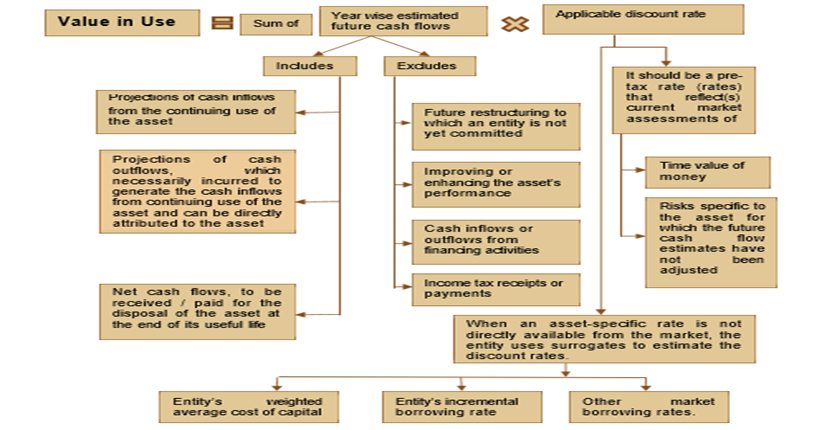

| 9. Value in use – The present value of the future cash flows expected to be derived from an asset or cash-generating unit. |

Testing of Impairment

-

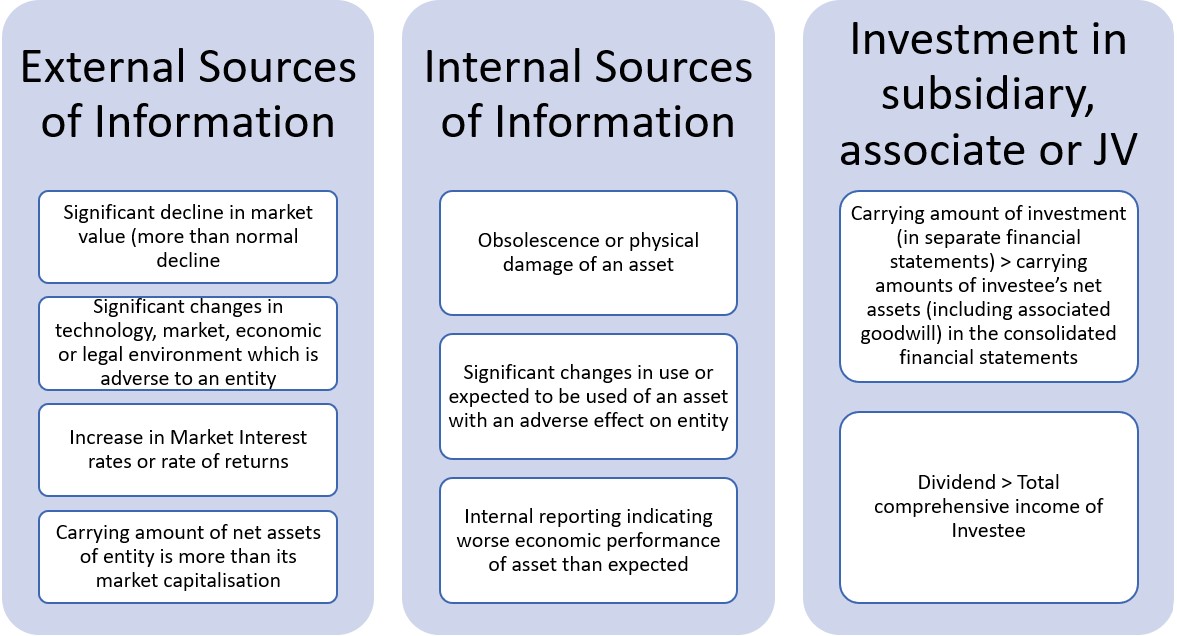

- An entity shall assess at the end of each reporting period whether there is any indication that an asset may be impaired. If any such indication exists, the entity is required to estimate the recoverable amount of the asset.

- Irrespective of whether there is any indication of impairment, an entity is required to test following items for impairment at least annually:

1) Intangible asset with an indefinite useful life

2) Intangible asset not yet available for use

3) Test goodwill acquired in a business combination for impairment annually

-

- For above three assets, the entity should not have wait for Impairment indicators, rather there is mandate of impairment testing.

Indicators of Impairment

Difference between Fair value and value in use

Fair value differs from value in use. Fair value reflects the assumptions market participants would use when pricing the asset. In contrast, value in use reflects the effects of factors that may be specific to the entity and not applicable to entities in general. For example, fair value does not reflect any of the following factors to the extent that they would not be generally available to market participants:

Estimates of future cash flows shall exclude:

-

- Additional value derived from the grouping of assets (such as the creation of a portfolio of investment properties in different locations);

- Synergies between the asset being measured and other assets;

- Legal rights or legal restrictions that are specific only to the current owner of the asset; and

- Tax benefits or tax burdens that are specific to the current owner of the asset.

Points to be kept in Mind while computing Value in Use

-

- Points to be considered while projecting cash flow

Estimates of future cash flows shall exclude:

-

- Projections of cash inflows from the continuing use of the asset;

- Projections of cash outflows that are necessarily incurred to generate the cash inflows from continuing use of the asset (including cash outflows to prepare the asset for use) and can be directly attributed, or allocated on a reasonable and consistent basis, to the asset;

- Net cash flows, if any, to be received (or paid) for the disposal of the asset at the end of its useful life. The estimate of net cash flows to be received (or paid) for the disposal of an asset at the end of its useful life shall be the amount that an entity expects to obtain from the disposal of the asset in an arm’s length transaction between knowledgeable, willing parties, after deducting the estimated costs of disposal

- Net cash flows, if any, to be received (or paid) for the disposal of the asset at the end of its useful life. The estimate of net cash flows to be received (or paid) for the disposal of an asset at the end of its useful life shall be the amount that an entity expects to obtain from the disposal of the asset in an arm’s length transaction between knowledgeable, willing parties, after deducting the estimated costs of disposal

- Projections of cash outflows include those for the day-to-day servicing of the asset as well as future overheads that can be attributed directly, or allocated on a reasonable and consistent basis, to the use of the asset and

- In the same way that corporate assets can be allocated to a CGU’s carrying value, the CGU’s cash flows shall also include an appropriate apportionment of corporate overheads when calculating value in use. However, care should be taken around internal charges for using the asset.

Estimates of future cash flows shall exclude:

-

- Cash inflows from assets that generate cash inflows that are largely independent of the cash inflows from the asset under review (for example, financial assets such as receivables);

- Cash outflows that relate to obligations that have been recognised as liabilities (for example, payables, pensions or provisions);

- Future cash outflows or related cost savings (for example reductions in staff costs) or benefits that are expected to arise from a future restructuring to which an entity is not yet committed.

- Estimated future cash flows that are expected to arise from improving or enhancing the asset’s performance, i.e. the general rule is that future cash flows should be forecasted for CGUs or assets in their current condition.

- Income tax receipts or payments. Because the discount rate is determined on a pre-tax basis, future cash flows are also estimated on a pre-tax basis; and

- When corporate assets have been allocated to a CGU’s carrying amount, any internal charges incurred by the CGU for using such assets shall not be included in the CGU’s expected future cash flows. To do so would be to double-count the impact of the corporate assets and could result in an impairment loss being recognized incorrectly.

-

- Points to be considered while computing discount rate

-

- The discount rate (rates) shall be a pre-tax rate (rates) that reflect(s) current market assessments of:

1) The time value of money; and

2) The risks specific to the asset for which the future cash flow estimates have not been adjusted.

-

- This rate is estimated from the rate implicit in current market transactions for similar assets or from the weighted average cost of capital of a listed entity that has a single asset (or a portfolio of assets) similar in terms of service potential and risks to the asset under review. However, the discount rate(s) used to measure an asset’s value in use shall not reflect risks for which the future cash flow estimates have been adjusted. Otherwise, the effect of some assumptions will be double counted.

- When an asset-specific rate is not directly available from the market, an entity uses surrogates to estimate the discount rate.

Guideline for selecting appropriate discount rate

-

- It should be adjusted to reflect the specific risks associated with the projected cash flows (such as country, currency, price and cash flow risks) and to exclude risks that are not relevant;

- To avoid double counting, the discount rate does not reflect risks for which future cash flow estimates have been adjusted;

- The discount rate is independent of the entity’s capital structure and the way it financed the purchase of the asset;

- If the basis for the rate is post-tax (such as a weighted average cost of capital), it is adjusted for the Value in Use (VIU) calculation to reflect a pre-tax rate; and

- Normally, the entity uses a single discount rate but it should use separate discount rates for different future periods if the VIU is sensitive to different risks for different periods or to the term structure of interest rates.

- The discount rate specific for the asset or CGU will take account of the period over which the asset or CGU is expected to generate cash inflows and it may not be sensitive to changes in short-term rates.

Summarizing value in Use