ESOP

1. Meaning of ESOP

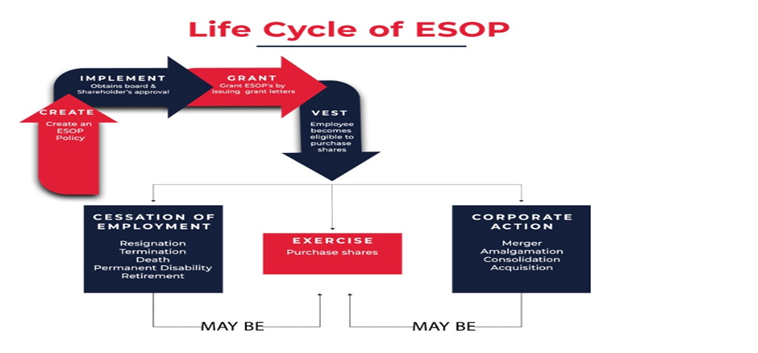

ESOP is a plan under which the Company grants employees stock option. Employee Stock Option is a plan that gives the employees of the company, the option for a specified period of time to purchase or subscribe to the shares of the company, at a fixed determinable price. Employee Stock Option Plans, or ESOPs, incentivize employees for performance. Many firms use ESOPs as a retention strategy to retain employees in the long term. When a company awards an ESOP to an employee, they get a ‘right to purchase’ shares in the company at a predetermined price. This right is usually subject to certain conditions.A critical difference between issuing stocks and issuing ESOPs is that the stockholder becomes a startup owner when startups issue stocks to investors. However, in the case of ESOPs, employees get a “right” to become an owner in the future, subject to certain conditions. ESOPs are also called Employee Stock Ownership Plans.

2. ESOP Issue under companies act to whom

According to Rule 12(1) of Companies (Share Capital and Debentures) Rules, 2014, companies can issue ESOPs under Companies Act, only to the following:

-

- A permanent employee of the company – such an employee can work in India or outside India.

- A director of the company can either be a whole-time director or not. However, companies cannot issue ESOPs to an independent director (because it will affect his independence!)

- Any person falling under the definition of (a) or (b) belonging to a subsidiary or the holding company.

The rule also clearly identifies persons to whom companies cannot issue ESOPs:

-

- A person being a promoter.

- A person belonging to the promoter group.

- A director who holds more than ten per cent of the equity of the company both directly or indirectly

In most companies, the issue of such ESOPs is governed by the Employee Stock Option Scheme (ESOS).

3. Why is ESOP Valuation Important?

There are two primary reasons why ESOP valuation is crucial:

-

- Accounting: Companies need to account for ESOPs as a compensation expense on their income statement. The valuation determines the cost associated with issuing stock options to employees over the vesting period. This impacts the company’s earnings per share (EPS).

- Taxation: The valuation of ESOPs directly affects the tax liabilities of both the company and the employees. An accurate valuation helps avoid tax disputes and penalties for both parties.

- Company: A lower valuation can lead to a higher compensation expense, reducing EPS.

- Employee: The perquisite tax payable by employees on exercising their stock options is determined by the valuation. An overvalued option could result in unexpectedly high tax bills for employees, potentially making the ESOP program less attractive.

4. ESOP Valuation when triggered

| Particulars |

At the Time of Grant |

At the time of Exercise |

| Purpose of Valuation |

Accounting of ESOP cost by the Company |

Determination of perquisites value in the hands of the employee |

| Valuation to be done under |

Companies Act |

Income tax act |

| Valuation to be carried out by |

Registered Valuer |

Merchant Banker |

| Items to be Valued |

Equity shares and options |

Equity shares |

| Due care to be taken |

Other valuation undertaken by the company around that time |

Methods for valuation

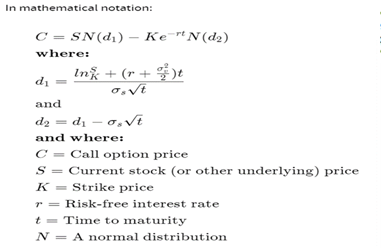

Black scholes Method

Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate. It is the widely used method

Binomial Model

The binomial option pricing model values options using an iterative approach utilizing multiple periods to value American options. With the model, there are two possible outcomes with each iteration—a move up or a move down that follow a binomial tree.

Monte Carlo Model

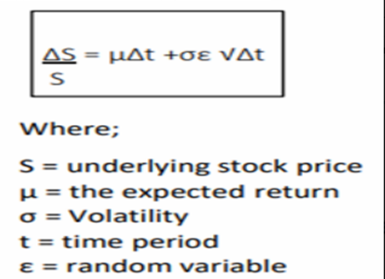

Monte Carlo is used for option pricing where numerous random paths for the price of an underlying asset are generated, each having an associated payoff. These payoffs are then discounted back to the present and averaged to get the option price.